REPORT

Return Economics 2026

Exclusive insights from the UK's top 100 retailers on managing return costs

Return economics research for retail executives in 2026

Is your brand still focused on reducing return rates? Our research shows that's the not the only lever. This report reveals the real margin opportunities within your returns strategy:

- Real numbers that matter. 35% of the UK's top 100 fashion brands now charge for returns, up from 23% in 2023. See how return fees, windows, and basket strategies are reshaping retail economics.

- With over 70% of fashion returns stemming from fit uncertainty, it's worth looking closer at managing return economics rather than chasing rate reduction.

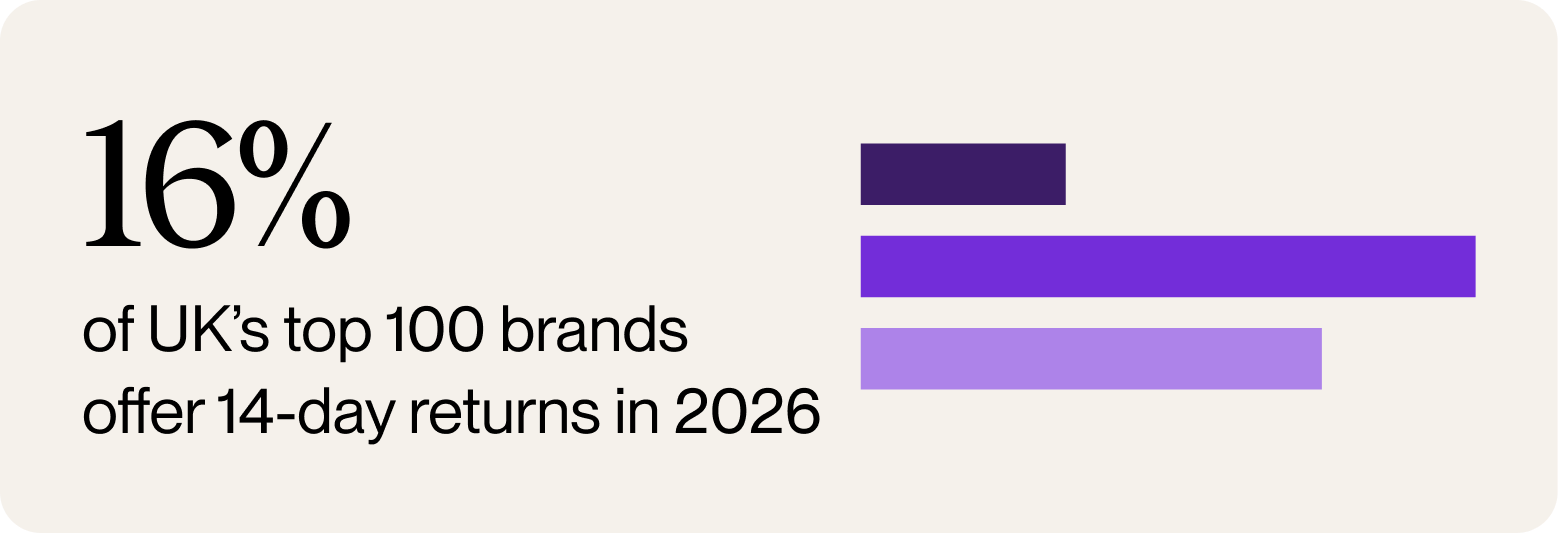

- Customers act fast, policies don't. UK shoppers initiate returns in an average of 12.4 days, perfectly within a 14-day return window. Find out why most brands are leaving margin on the table with 30-day policies.

Is your retail brand shifting the focus from top-line growth to business profitability? If so, pricing your e-commerce delivery and returns must be one of the biggest questions your team wants to answer before 2025.

More than price and speed

It was previously believed that price and speed were the primary factors influencing delivery choices for online shoppers. Recent data, however, suggests that it's only part of the story.

While 32% of shoppers choose the cheapest delivery option and 17% are ready to spend more for the fastest delivery, 35% of customers do not have a clear preference for either speed or price. For the remaining 15%, delivery decisions are driven by specific factors like trusted carriers, pick-up availability, named day delivery, sustainable choices, etc. We have also found that 34% of customers are likely to change their delivery preference on repeat purchases.

Research shows that offering and visualizing 3 to 5 delivery options is optimal, providing flexibility without overwhelming customers and improving checkout conversions — brands that offer multiple delivery options see a 27% checkout conversion rate increase.

The end of free shipping?

Statistics reveals that UK consumers prioritize delivery cost before availability and speed. While free delivery options seem essential for competitiveness, they can be financially challenging for retailers.

About 59% of UK shoppers expect retailers to offer free delivery at checkout, but 38% say it depends on the type of product, and 30% of customers are willing to pay for delivery even when there's a free option, meaning they are ready to splurge on added value.

A/B testing is crucial for refining delivery strategies. Defining what to test is essential, as balancing conversion rate, average order value (AOV), and shipping revenue is tricky — positive outcomes in all areas are rare. Understanding the competitive landscape and how shipping price tweaks affect revenue is key.

Introducing a free shipping threshold, with careful calibration to avoid a significant drop in conversions, helps retailers avoid loss-making transactions, especially with low-margin items — 60% of customers say they will add items to cart to avoid delivery fees.

Some brands, like NET-A-PORTER , offer free delivery as a perk for customers who reach higher tiers in their loyalty programmes, encouraging frequent shoppers to maintain their tier status.

Effective strategies for reducing the burden and impact of returns

Get a free copy of Delivery and Returns Pricing Strategy 2024 by Harper and Ingrid to keep reading about the use of exchange platforms, product feedback analytics, engaging with serial returners, dynamic return windows, wardrobing prevention, and much more.

- 100 top UK retailers;

- Over 130 million deliveries;

- Data, insights, analysis;

- No fluff, just facts.

Insights

Original benchmarks from 100 UK fashion retailers, comparing return fee adoption, return windows, and policy structures in 2026 vs. 2023, as well as qualitative insights gained from conversations with UK top retailers as part of Harper and Ingrid's breakfast series.

Analysis

Why return rates are stubbornly resistant to change, but return economics are not. The report unpacks the levers within your direct control, including shopping basket strategies, return fees, and return windows.

Data

Data from across Harper and Ingrid platforms that focuses primarily on the UK market, with comparative benchmarks from the Nordics to illustrate how return behaviours vary across mature e-commerce markets.